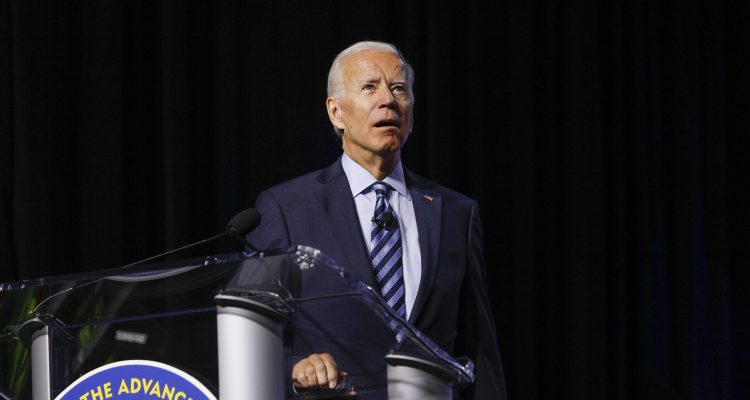

PROMISE MADE, PROMISE BROKEN: Joe Biden Tax Hikes Hurt People Making Less Than $400K

Just as Americans are starting to recover from the pandemic, President Biden wants to raise taxes and then lies about who it will impact.

March 19, 2021

“Nobody making under 400,000 bucks would have their taxes raised. Period. Bingo,” said then-presidential candidate Joe Biden. But the message quickly shifted once Biden took office. After a clarification from the White House Wednesday, it’s clear Joe Biden didn’t really mean what he said.

During a White House press briefing this week, Jen Psaki lowered the bar by explaining that certain individuals making $200,000 could also be impacted.

CNBC: “She clarified on Wednesday that the $400,000 threshold applies to families, not individuals. Consequently, individuals who make $200,000 could be affected if they are married to someone who earns that same amount, for example.”

And while Joe Biden claims his tax increases are only meant to affect the wealthy, studies show hardworking Americans are most likely to bear the brunt.

Tax Foundation: “Payroll taxes are imposed on both employers and employees, but public finance scholars generally agree that the burden of both sides of the tax is borne by employees, the employer side contribution in the form of lower wages. While wage stickiness would likely mean that it would take several years for employees to bear the full burden of a newly-imposed donut hole payroll tax (wages would grow more slowly until this was accomplished), this would be the long-run result.”

But do you know who IS protected under President Biden’s tax plan? The “coastal professional class” that Democrats rely on to win elections.

WSJ: “The dividing line is no accident: It was intentionally set to far exceed any definition of the middle class. And it spares much of the coastal professional class that is an important part of the Democratic coalition.”

Axios: “Democrats, including Senate Majority Leader Chuck Schumer (D-N.Y.), are pressing the White House to repeal the $10,000 limit for deducting state and local taxes — the so-called SALT cap — from their federal tax bill…

“But many voters in high-tax (and Democratic) states — like New York, New Jersey, Connecticut, Maryland and California — hate the limit. The provision is scheduled to expire in 2026.”

Bottom line: Just as Americans are starting to recover from the pandemic, President Biden wants to raise taxes and then lies about who it will impact.

Keep tabs on the Democrats. Sign up for news.

Keep tabs on the Democrats. Sign up for news.